vermont sales tax on cars

Web Please note. Web If you have a business in Burlington Rutland City or St.

Best Audi S5 Deals Near Montpelier Vt In November 2022 Cargurus

Albans City please contact the appropriate city for information on how to pay and remit the tax.

. Web 15th highest liquor tax. In addition to taxes car purchases in Vermont may be subject to other fees like registration title and. Contact the City of.

Local rate range 0-1. Web Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. A 1 There is hereby imposed upon the purchase in Vermont of a motor vehicle by a resident a tax at the time of such purchase payable as hereinafter provided.

Therefore you will be required to pay an additional 6 on top of the purchase price of the vehicle. Total rate range 6-7. That tax money is not transferred to Vermont.

Vermonts excise tax on Spirits is ranked 15 out of the 50. Web 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Web The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxation.

Web Get a quick rate range. The only way to get any portion of it refunded to you is to contact. Web Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain.

You are required to select the type. Web Several states including Florida will collect taxes equal to the rate of your home state. Web In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Vermont Use Tax is. Base state sales tax rate 6. The sales tax rate is 6.

An example of items that are exempt from. Web The state sales tax on a car purchase in Vermont is 6. Web In Vermont the state tax rate of 6 applies to all car sales but the total tax rate includes county and local taxes and can be up to 7.

In this example the Vermont tax is 6 so they will charge you 6 tax. The average total car sales tax. Vermont state sales tax rate range.

Due to varying local sales. Vermont Use Tax is imposed on the. The sales tax rate is 6.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Web Vermont collects a 6 state sales tax rate on the purchase of all vehicles. Local option tax does not apply to the sale or rental of motor vehicles which are subject to the motor vehicle purchase and use tax.

Sales Taxes In The United States Wikipedia

The States With The Lowest Car Tax The Motley Fool

Should I Buy An Out Of State Car Edmunds

Vermont Bill Of Sale Title Process 2020 Update Youtube

Used Cars Used Trucks Used Suvs For Sale In Vt 802 Honda Of Vermont

Used 1997 Lamborghini Diablo Vt Roadster 1 260 Miles Collectors Car 5 Speed Gated Manual For Sale Special Pricing Chicago Motor Cars Stock 16051a

Used Cars Trucks Serving White River Jct Vt Lebanon Nh Upper Valley Auto Mart

Bill Of Sale Only Title Cartitles Com

Used Cars Trucks And Suvs For Sale In Vermont 802usedcars Com

Sales Taxes In The United States Wikipedia

Used Cars For Sale In Barre Vt Vermont Mcgee Chrysler Dodge Jeep Ram Of Barre

Welcome To Springfield Buick Gmc In N Springfield Vt

Vermont Will Give You 3 000 To Give Up Your Gas Car For An Ev Carscoops

Used Cars Trucks Suvs For Sale In Montpelier Vt Preston S Kia Near Burlington Vt

How To Use The Vermont Title Loophole To Get A Vehicle Title Cartitles Com

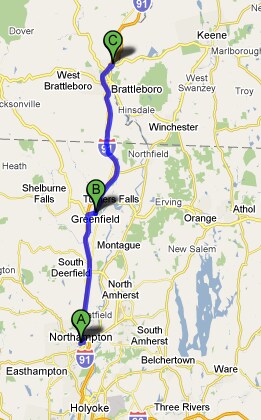

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

Used Cars For Sale In Montpelier Vermont Mcgee Ford Of Montpelier